I joined Capital One as part of a team building on 2+ years of research to define the 21st Century vision for Capital One's local footprint, with an interest in making client engagement less transactional and more relational. Specifically, I was engaged to help scale and operationalize a prototyped service called "Money Coaching," and to roll it out to 450 Capital One Cafe and Branch locations across the United States. I integrated myself onto the team as a strategist, supporting a Service Design Lead and then assuming Lead responsibilities upon his departure.

Over the course of three free Core Sessions with a certified Money Coach, a client works to gain control of her financial wellbeing by identifying a stress area and co-designing a plan to overcome that issue.

One of our primary objectives was to ensure that, even after completing her third session, each Money Coaching client continues to feel a sense of empowerment on her path to achieving her goals. Accordingly, between 2 and 6 months after a client’s final session, she can now attend a Look Back Look Forward Session with her Money Coach to celebrate her successes, assess her challenges, and leverage insights from her experiences to carve out a clear path forward.

The design of this offering, guided by a Look Back Look Forward paper tool and anticipated by the handoff of a Travel Log Journal at the closing of the final core Money Coaching session, was informed by three universal Post-Session-Three-client needs uncovered in key stakeholder interviews: a need for affirmation, a need for accountability, and a need for thought partnership.

We also delivered a set of agile worksheets to help Coaches support client journeys through the core session challenges of of Getting Clarity, Removing Roadblocks, and Making a Plan, providing opportunities to create tangible takeaways that benchmark and reinforce client progress without constraining in-session dialogue.

For our work on Cafe Money Coaching, we were recognized as finalists for a Global Service Design Award.

Identifying an Opportunity

As a free offering for Capital One customers and non-customers alike, Money Coaching pairs each client with a certified Money Coach who, over the course of three core sessions, supports the client in getting clarity about their relationship with money; removing roadblocks from that vision; and making a plan for the journey forward. Client and coach feedback indicated the experience of ending after that third session felt abrupt and incomplete; accordingly, my challenge was to figure out the most appropriate way to serve a client after completing their third core session.

Understanding the Opportunity: Studying How We Feel Progress

I conducted lots of primary and secondary research (including five analogous research interviews) to better understand how we, as people, experience the sensation of progress- how we understand it and react to it and share it and leverage it.

We saw the matter of feeling progress not just as an opportunity to improve our understanding of how we might design activities occurring after the third Money Coaching session, but to also potentially inform our thinking about intra-session attrition rates, the perceived value that Money Coaching delivers from session to session, and how clients internalize it.

This research revealed a ripe opportunity to help Coaches support client journeys through the aforementioned phases of Getting Clarity, Removing Roadblocks, and Making a Plan with agile paper tools to . However, our coaches taught us that different clients would have different objectives, and that we should not expect every client to serve all three of these goals across not all clients will pursue all of these phases of progress across their three sessions. Accordingly, we needed to first benchmarking the client's state of mind in a given session, without feeling that Capital One overly prescriptive. We tools that could serve as references between sessions

This research revealed a ripe opportunity to help Coaches support client journeys through the aforementioned phases of Getting Clarity, Removing Roadblocks, and Making a Plan with agile paper tools to . However, our coaches taught us that different clients would have different objectives, and that we should not expect every client to serve all three of these goals across not all clients will pursue all of these phases of progress across their three sessions. Accordingly, we needed to first benchmarking the client's state of mind in a given session, without feeling that Capital One overly prescriptive. We tools that could serve as references between sessions

Key Insight #3: Waiters Were Already Overwhelmed and Spring Needed to Provide Them with a Direct Incentive

I discovered that waiters already have an overwhelming task load; they are expected to memorize revolving menus, record and input orders, touch in with kitchen expediters, deliver food, conduct table touches, communicate with busboys, clear tables, offer final courses, process payment, etc. No matter how simple Spring made its tablet signup UX, this additional task would always feel like too much work to expect without providing some sort of direct incentive.

Understanding an Opportunity

I presented these insights to our founder, who then tasked me with owning this product-opportunity gap. Synthesizing these inputs, I used Pivotal Tracker to work across our organization and remotely coordinate the development of an enrollment attribution mechanism, so that Spring could pay servers directly for signing up customers. My founder told me that we would pay $10 to acquire a new customer in the Spring Network. I deployed a simple questionnaire to the staff of a full-service restaurant and a fast-casual concept, which revealed that an incentive of $5 per enrollment was entirely sufficient to inspire enthusiasm and intent among servers (in retrospect I could have also tested $10 in parallel to assess for any further lift).

Designing a Solution

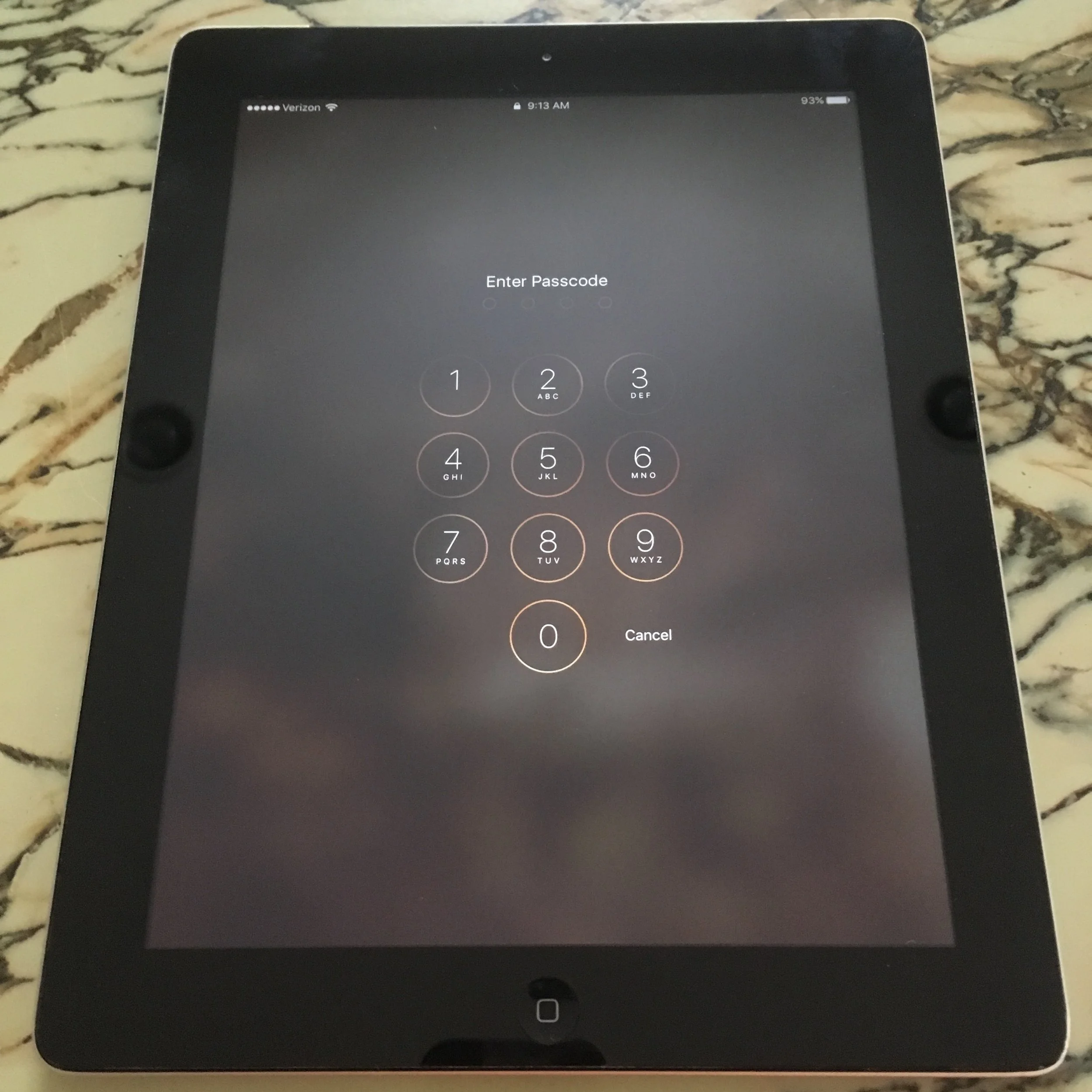

The enrollment attribution mechanism called for a set of location-specific employee IDs for use across a location's dedicated tablets. I employed interviewing, observation, co-design tools and usability testing to determine the best way to have employees identify themselves, knowing that the best experience would be efficient, intuitive, precise, and easily repeated. Our solution ultimately was a 4-digit PIN entered via a replica of the IPad unlock screen, based on the following insights:

- Users felt this "should be a single-screen process," and were very stressed by the idea of spending time completing this task across multiple screens

- Users wanted enough complexity in their single-screen process to avoid accidentally giving their incentive to a coworker (e.g., touching the wrong name/avatar on a screen)

- We found fingerprint scanning extremely unreliable with soiled hands and shared tablets

- Users wanted a familiar experience that would require no upkeep or additional learning

Implementation Design

As end-to-end service design lead in this project, I also owned introduction of the solution to stakeholders. We rolled out a formal “kickoff event” for all staff of each shift of service to attend with their management on hand to ensure buy-in. At a kickoff event, the dedicated Spring Program Manager would explain the process, review best practices, and sign servers up for payment with Square Cash (using only an email address and a debit card- no bank routing number or account number is required).

Measuring Performance

Within a month of re-deployment, tablet signup became #1 among our six customer acquisition channels; within three months, we enrolled 10x more customers with tablets than we had across all other channels in that time. And we did this at 50% of our new customer acquisition cost.

This dramatic, efficient uptick in customer acquisition proved a key factor in our ability to secure a second round of convertible debt funding.

Impact at Scale

The enrollment attribution mechanism became especially valuable with our larger, event-based clients, such as the Nashville Predators in their games at Bridgestone Arena. We enrolled over 1,100 customers into the "Preds Gold" program in a single night, and happily paid our contracted "Ambassadors" $5 per customer enrolled. This mechanism has been used to enroll some 500,000 customers into the Spring Network since its rollout in March 2014.